Usually companies pay management consultants a couple of cool million to have this kind of analysis, but consider this my present to Jim Pohlad for his inaugural season as the managing owner of the Twins, and I hope he puts that extra couple of million towards the payroll :)

This segment would deal with how the Twins can capture more market revenue.

As a reminder, the market revenue capture (i.e how much money goes to a major league team for every $10,000 made in its market) for an average league team is 7.80, for the Twins is 6.58, for the Royals 10.02 and for the Indians a league leading 13.30.

Here are how the Twins can pull this off (and there are well into their way, believe me):

The first 2 steps are easy:

a. Keep fielding a competitive team:

This might be a no-brainer, but here is the data (and lets look at the year 2010, which will be the year after which a lot of Twins' players are about to hit some serious paydays) :

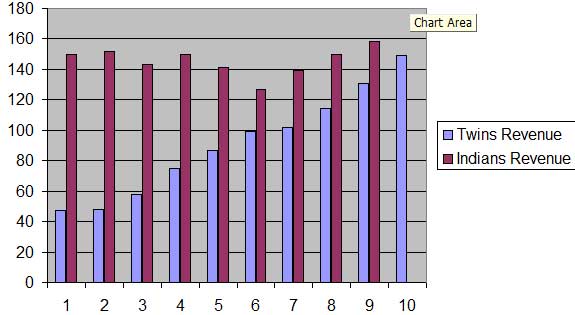

This graph compares the Twins' and Indians' (remember, they are kind of the holy grail keepers of revenue capture in the bigs) revenue in the last 10 years. Year 10 is 2008 (no data for the Indians). The numbers are from Forbes and you can find the Twins' numbers here and the Indian's here. As you can see, when the Twins became competitive, their revenue increased dramatically. A revenue that was flat in 1999 (the first year) and 2000 (year 2) increased dramatically every year, but 2005 (when the Twins were not competitive). The average increase in the years from 2003 on (I am leaving 2001 and 2002 off because the revenue jumped 20.1% and 29.3% respectively from the previous years; and this is an unsustainable pace because the Twins became from about to be contracted to division champions. I am also leaving 2005 off because they were not competitive.) was 14%. If they sustain this by being competitive and winning something, the 2009 revenue will be $161 million and the 2010 revenue will be $183.5 million. That would mean that at 2010, the Twins will jump ahead of Royals with a 10.59 revenue capture, which will allow them a $100.1 million player payroll without any hardship. It is that easy... they just have to say competitive.

b. Get the stadium going

This part is even easier than the first part, because the new stadium is well in its way. What would the revenue impact of a new stadium be? Here is a nice, technical article that looks at the impact of a new stadium in attendance and determined that in the first season, a new park could realize an attendance boost of 758,308 fans. Given that the average Twins' fan spends about $100 in the park (in the dome nevertheless), even if the number is closer to 500,000 more fans, we are looking at an additional $50 million of revenue for 2010, the first season of Target field. That would boost the above number of total potential revenue to $233.5 million, which will result to a 13.47 revenue capture (Indians territory), which would allow for a $127 million player payroll, without any hardship.

Here you have it. But this is not the whole story. There are a couple more things in play that need to be accounted for:

The economic situation. Believe it or not, this has already been accounted for. By using the 2007 data for the Twins' Market area income, to calculate revenue capture in 2009 and 2010, I assume that the Market area income will stay at 2007 levels the next 2 years (which, since income increased in 2008) is a very pessimistic scenario. But here is the biggie:

League Revenue. By ralizing more revenue and spending more in player salaries, the Twins will probably not have to pay a luxury tax, but some part of revenue sharing will decrease. How do they off-set that? Here is how (and not to underestimate the fact that the Twins will be having some money coming in from the naming rights to their stadium that hasn't been accounted here and could be worth up to $8 million a year for 25 years:

c. Expand the horizons

The Twins' need to think more than their Minnesota and Dakotas, "Twins' Territory" and try to capture more than those markets.

For starters one thing that 90% of the Twins' fans are not aware, is that the franchise is one of the original 8 1901 American league founding franchises. If the Boston Red Sox can embrace the Boston Americans' history, the Oakland Athletics, the Philadelphia Athletics' history, the Cleveland Indians the Cleveland Blues' history, the Twins should embrace the Washington Senator's history, forget about the bitter divorce of the Griffith's with the Capital City, once in a while wear throw back uniforms with W's on them and hang pictures of Walter Johnson, Goose Goslin, Sam Rice, Joe Cronin, Bucky Harris and Heinie Manush along those of Oliva, Kirby, Hrbek and Killebrew on the Target Field concourses or where their new monument park will be. Just think of the merchandise sales.

There are several states both in the upper Midwest and Northwest that are not covered by the Twins' radio and television programming, which are ripe for picking: Iowa, Nebraska, Wyoming, Montana, Utah, even parts of Wisconsin are ripe for picking. It will not take what Ted Turner did (creating a national station that televised for free all of his team's games), but the Twins can market the TV and Radio rights aggressively to stations in these markets that have no programming and whose residents would not mind listening to or watching a following a baseball team in the summer. Here is the current Twins' radio network map. Pretty limited. Also, why not target the areas of current minor league Twins' franchises?

The Twins got to build goodwill with the community. Last year the average attendance in the dome was 25000 people. That means that about 20000 tickets in every game remained unclaimed. A very simple solution will be to give away 50% of their unclaimed tickets to disadvantaged families and kids. Just give them away. Not only that would bring more people in the park to cheer the team and set the Twins as a great corporate citizen, but will bring in revenue (as in parking and concessions) to their coffers.

Their you got it. This is the plan for the Twins becoming a perennial contender with a $125+ million payroll, generating sufficient profit and paying back the community.

Eat your hearts out Yankees.

What do you think? Feel free to commend here or email me at thetenthinningstretch at gmail.com

1 comment:

You would think that successful business people would have covered these bases, but you'd have to believe that there are stations in South Dakota, Montana & Wyoming that would be interested. A bigger presence in Iowa makes sense. Perhaps Nebraska, too.

Perhaps the new ownership will look into this. The next team west is Seattle. A lot of real estate is unclaimed. Seize it!

Some fun things to think about.

Thanks. Great articles.

Post a Comment